Customer Identification Program: Unlocking Trust and Security

From banks and credit unions to insurers and lenders, all financial institutions around the globe share the same critical responsibility: truly knowing who their customers are. And it’s not just a good business practice – it’s the law aimed at preventing money laundering, fraud, terrorist financing, and other financial crimes.

The framework that makes this possible is called Know Your Customer, or KYC for short. At the heart of KYC lies the Customer Identification Program (CIP) – the key first step in building trust and security.

In this article, we’ll break down what a CIP actually is, how it works in practice, the must-have elements every program needs to meet Anti-Money Laundering (AML) standards and walk you through the CIP process step by step.

Requirements for Customer Identification Programs

To effectively combat money laundering, all CIPs must meet six key criteria as outlined in the CIP Final Rule, originally established under the USA PATRIOT Act and subsequently adapted in many jurisdictions worldwide. Let’s zoom in on the key requirements:

- Establish a well-documented and board-approved CIP program, integrated into an overall anti-money laundering framework.

- Collect four specific pieces of identifying information from customers: their full legal name, proof of address, date of birth, and government-issued identification number.

- Implement customer identity verification procedures.

- Maintain record-keeping and retention standards mandated by the law.

- Compare against official lists, such as government registries, to ensure that no prohibited individuals or entities are onboarded.

- Notify customers that their information is being requested for identity verification in order to comply with legal requirements.

- While the CIP Final Rule establishes a standardized framework, it allows some flexibility in implementation, i.e. the application of a risk-based approach to determine the depth of customer due diligence.

For example, under the category of low-risk customers may be salaried individuals with standard financial products, so they may undergo a simplified type of verification. Meanwhile, politically exposed persons, cross-border clients, or complex entities are viewed as high-risk customers, so they may require enhanced due diligence, including additional identity checks, source-of-funds verification, or ongoing monitoring.

Finally, the CIP Final Rule also offers a principles-based framework for institutions who are able to decide how they design and execute their CIPs, as long as they meet the core requirements of clearly documented records, periodic, board-approved reviews, quality assurance, and internal audit.

The Customer Identification Procedure in Detail

Although CIP procedures may vary slightly in different industries, there are certain mandatory components in a typical customer identification program. Let’s examine them in greater detail.

Structure and Documentation of the CIP

If your business is subject to the CIP Rule, merely having a customer identification program isn’t sufficient. It must be meticulously documented and shared with all employees involved in the process. This document should outline the entire CIP process, including instructions for potential risk scenarios, such as politically exposed persons (PEP) or reputational risk media.

Additionally, it should include your business’ privacy and security policies, and outline the proper methods for collecting, storing, retrieving, and accessing customer information.

Key Customer Information Requirements

In line with the CIP program, you’re required to collect four key pieces of information for each new customer: name, date of birth, address, and an identification number (for example, Social Security Number (SSN), Taxpayer Identification Number (TIN), passport number). However, businesses can choose to collect and verify additional information based on their unique needs and risk factors. Commonly connected data, such as phone numbers and email addresses, can also be incorporated into your CIP processes for enhanced verification methods.

Methods of Customer Identity Verification

The CIP rule requires businesses to verify the identity of all new customers, but it doesn’t specify how they must do it. Essentially, FinCEN, states you just need to gather enough information to form a reasonable belief that the customer is who they claim to be. This can be done using a mix of methods such as document verification, database checks, and biometric verification – each using different aspects for authentication.

Here is how Documentary and Non-documentary methods of identity verification differ:

| Method | What it is | How it works |

| Documentary | Using physical or digitized documents issued by a government or reliable source. | The bank examines a document, like a driver’s license, passport, or utility bill, to match the customer’s name, date of birth, and address. |

| Non-Documentary | Using data and information from independent sources, without relying on physical papers. | The bank cross-checks the customer’s information against credit bureaus, consumer reporting agencies, public databases, or fraud prevention services to verify its accuracy. |

Record-keeping Requirements

Businesses must keep all customer information, including what they collected and what they used to verify a customer’s identity, for the entire time the account is open, plus an additional five years after the account is closed.

Screening Against Government Lists

The CIP rule requires businesses to continuously check their customers against official government watch lists (for example, sanctions lists maintained by the Office of Foreign Assets Control in the US) to make sure they aren’t dealing with known or suspected terrorists (or terrorist organizations), sanctioned individuals, or politically exposed persons.

This screening isn’t a one-time thing; it has to happen throughout the customer relationship. Although not required, businesses often use extra tools, like screening social media, checking address history, or phone/email risk, for additional scrutiny, especially for the high-risk customers.

The Importance of Customer Notice

Businesses are required to provide customers with adequate notice when requesting information, documentation, or other materials for identity verification. This step helps you build trust, because you’re clearly explaining why you need the data. And when customers understand the reason for the collection, they’ll be much more likely to share the information that you need.

Distinguishing CIP from KYC

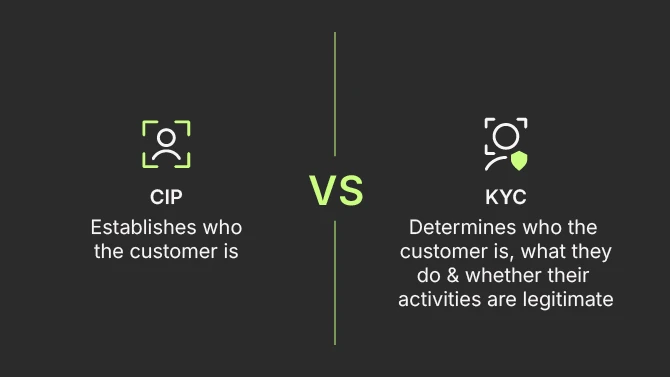

While the terms “Customer Identification Program” and “Know Your Customer” are often used interchangeably, it’s important to note that they are not precisely synonymous.

In simple terms, CIP is the first step in customer due diligence – it establishes who the customer is at the moment of account opening. Meanwhile, KYC is a broader, ongoing process – it determines who the customer is, what they do, and whether their activities are legitimate.

The CIP is used to perform a customer’s identity verification at the moment of account opening, while KYC is an ongoing process of monitoring and assessing risks.

| CIP | KYC | |

| Focus | Initial identification and verification at account opening. | Full customer due diligence lifecycle, including onboarding, risk assessment, ongoing monitoring, and enhanced due diligence. |

| Regulatory basis | CIP Final Rule under the USA PATRIOT Act (Section 326). | AML/CTF regulations (FATF Recommendations, EU AML Directives, FinCEN’s CDD Rule). |

| Objective | To ensure that financial institutions know the true identity of customers before providing services. | To assess and monitor customer risk to prevent money laundering, terrorism financing, and other financial crimes. |

| Timing | Implemented at account opening or customer onboarding. | Applied throughout the customer relationship, including periodic reviews and monitoring. |

| Information collected | Basic identifiers: name, address, date of birth, and government ID number. | CIP data + source of funds, source of wealth, occupation, business activities, transaction patterns, and risk tolerance profile. |

| Verification methods | Documentary and non-documentary identity verification (ID check, database verification). | Identity verification + ongoing due diligence, transaction monitoring, and risk reassessment. |

| Record-keeping requirements | Retain records for at least 5 years after account closure (per CIP Rule). | Retain broader customer and transaction records, often for 5–10 years, depending on jurisdiction. |

| Risk-based approach | Applied to the depth of verification (simplified vs. enhanced checks). | Inherently risk-based, adjusting the level of scrutiny depending on customer risk rating. |

| Governance & documentation | Written, board-approved, and includes specific identity verification and record-keeping procedures. | Embedded in the institution’s overall AML framework, governed by compliance policies and continuous review mechanisms. |

Who Falls Under the Jurisdiction of the CIP Rule?

Any entity identified as a financial institution according to the Bank Secrecy Act and its associated laws is obligated to establish a CIP program to prevent fraudulent activities.

Here we are talking not only about conventional financial institutions like banks, lenders, and brokers, but also insurance agencies, gambling services, payment companies, cryptocurrency exchanges, FinTech firms, and neobanks, if they are offering bank-like services.

But some businesses, even those not mandated by law to implement a CIP program, often choose to do so voluntarily, because they want to enhance customer experience and amplify overall business benefits. For instance, social media platforms and online dating services may opt for CIP programs to instill trust and provide a more secure environment for their users.

However, certain types of legal entities and accounts are exempt because their identity or regulatory oversight is already well-established.

| Existing customers | If a customer already has a verified account with the institution and the identity was previously confirmed, CIP procedures don’t need to be repeated, unless there’s a reason to doubt their identity. |

| Federally regulated financial institutions | Banks, credit unions, and broker-dealers that are federally regulated are exempt when they open accounts at other regulated financial institutions, since they’re already subject to CIP/AML oversight. |

| Governmental agencies and departments | Federal, state, and local government entities are excluded because their identities can be independently verified. |

| Publicly traded companies | Companies listed on the US stock exchange (NYSE, NASDAQ) and their majority-owned subsidiaries are exempt because they are subject to public reporting and disclosure requirements. |

Financial institutions must still define all CIP exceptions clearly in their board-approved CIP policy and maintain documentation demonstrating compliance.

Challenges and Best Practices for CIP

Implementing a CIP isn’t always easy, as compliance teams often face false positives during identity checks, which can waste time and delay onboarding. Another headache is outdated or inconsistent data, especially when customers change addresses, names, or documents, but records aren’t updated. And with the rise of digital onboarding, verifying remote customers securely and quickly adds another layer of complexity.

To overcome these challenges, institutions should use reliable, up-to-date data sources, including government registries and trusted third-party databases. Automation can also make a big difference: smart verification tools reduce manual work, minimize human error, and speed up decision-making. Finally, integrating CIP with broader AML and KYC systems ensures a seamless compliance ecosystem, where risk monitoring and identity verification work hand in hand.

A strong, tech-enabled CIP builds trust, improves customer experience, and keeps institutions ahead in the ever-evolving world of financial compliance.

The CIP Future is Digital

A well-designed CIP helps institutions stay both compliant and competitive. But today the lines between traditional finance and digital services blur, and that’s why the smartest players are moving toward data-driven, automated systems that make verification faster, more accurate, and nearly invisible to the customer.

In the end, the future of compliance is about smarter connections. A thoughtful, tech-enabled CIP can turn verification from a hurdle into a trust signal, setting the stage for smoother onboarding, stronger relationships, and safer financial ecosystems.